“Real risks for businesses”

In the group’s letter, SolarPower Europe CEO Walburga Hemetsberger said, “This makes it more likely that companies will go bankrupt because they will have to devalue a lot of their stock.” “We have already seen that on August 21, 2023, Norwegian Crystals, which made ingots, filed for bankruptcy.”

Hemetsberger said that wholesalers and developers who bought a lot of PV equipment didn’t take into account the effects of falling power prices faster than expected, rising interest rates, and tightening bottlenecks around grid connections and project permits. All of these factors contributed to a slowing of demand, but wholesalers and developers didn’t realize how much they would affect it until it was too late.

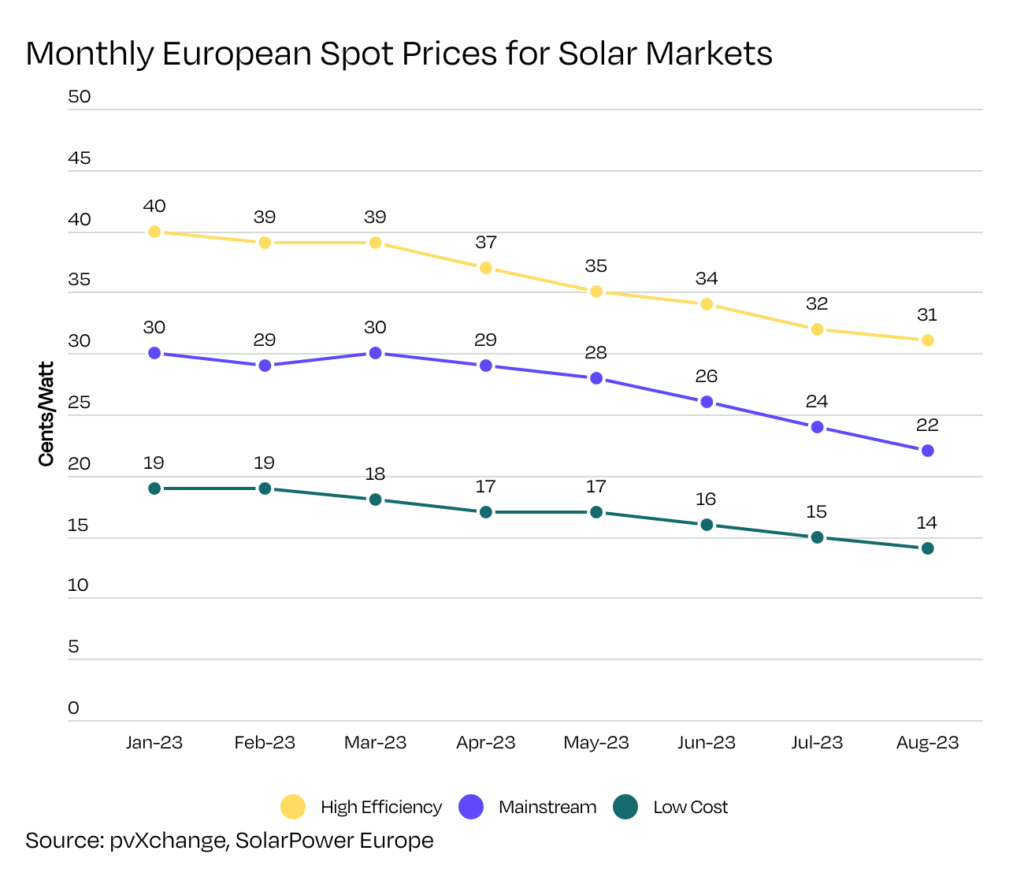

Prices have gone down across the board. Between January and August of this year, the price of a high-efficiency solar cell went from EUR0.40 (US$0.43) to EUR0.31. The average price of standard solar modules fell from EUR0.3 to EUR0.22 in the same time period, and the average price of low-cost solar panels fell from EUR0.19 to EUR0.14 in the first half of this year.

The price of PV modules fell by 92% between 1998 and 2022, according to a report from the Lawrence Berkeley National Laboratory. However, prices are now so low that SolarPower Europe is worried that European companies will find it hard to make money in the solar industry.

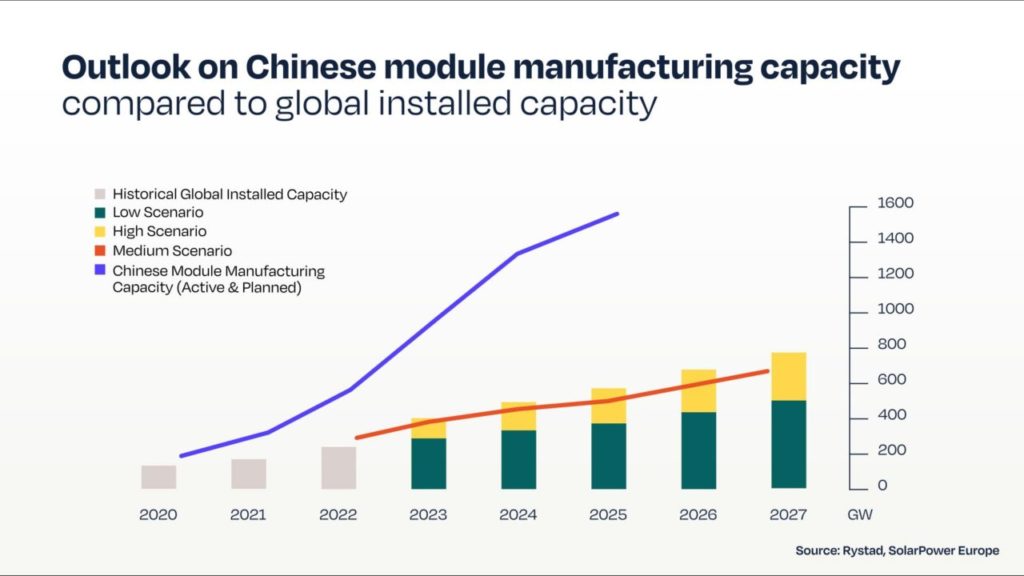

The body pointed to a “perfect storm” of strong global demand, large investments in new solar PV supply chains, and a shrinking European solar market in the second half of last year. These factors have led to overcapacity in the global supply chain, which has lowered the prices that manufacturers can charge for their products.

Too much production and not enough need

The excess of solar panels has already hurt the European solar industry. According to data from Rystad, 40 GW of Chinese PV modules are not being used because they are being stored in Europe.

Because the Inflation Reduction Act (IRA) is a major contributor to many of the issues SolarPower Europe mentions, the surplus of Chinese modules is crucial. Since the US doesn’t want to buy Chinese modules, Chinese companies have to sell them somewhere else. Since China doesn’t want to cut back on its huge solar production capacity, the price of panels made in Europe has gone down a lot.

“The combination of strong global demand signals during the pandemic (a demand-induced bullwhip effect) has led to new, large investments in solar PV supply chains and fierce competition between Chinese suppliers to get market shares,” said Hemetsberger. “This has led to big overcapacity all along the value chain, which has caused prices for everything from silicon to modules, inverters, and batteries to drop quickly.”

This has happened at the same time that there has been less desire for solar cells made in Europe in other parts of the world. Reuters reported in March that US imports of Chinese panels had started to rise again. This suggests that the IRA has only temporarily slowed down the supply line from China to the US, not that the US has had to look elsewhere for new modules.

In fact, the US Solar Energy Industries Association estimates that since the IRA was passed, the US’s focus on developing domestic manufacturing facilities has added $100 billion to the US economy. This suggests that the new law has not led the US to look to Europe to meet its demand for solar panels, as some in Europe may have hoped, but rather to look inward and secure domestic supply chains.

Getting back on track

In response, SolarPower Europe has asked the leaders of the EU to take seven steps to stop the drop in solar prices and give the European solar industry a more stable base.

Three of the group’s suggestions are more interesting, starting with buying the module stocks of European PV makers to stop the value of their inventories from going down. Even though this kind of direct action is rare, it wouldn’t be the first time. SolarPower Europe has asked the EU to use its “special-purpose vehicles,” which are emergency policies used to quickly reach a certain goal.

One example of this is how the EU kept trading with Iran in 2018 after the US pulled out of a deal with the country and started reimposing economic sanctions on Iran, which made trade between Iran and Europe more difficult.

Other suggestions include starting a solar manufacturing bank like the EU’s hydrogen bank, which was revealed earlier this year, to fund new solar manufacturing projects and make them more financially viable. The group also asks the EU to increase the demand for solar PV in Europe by, for example, making it a requirement that all new buildings be built with solar panels.

Many of these suggestions have to do with making European laws work better. For example, fixing “the inadequacies of the Temporary Transition and Crisis Framework” and speeding up the acceptance of the Net Zero Industry Act are both ways to do this. The group also asks for support for programs like the Solar Stewardship Initiative, which is a plan to make sure that good green practices are used all along the global supply chain, and for SolarPower Europe member states to work together more.

At the end of the message, Hemetsberger wrote, “If nothing is done, the Green Deal Industry Plan will not be put into place.” “Right now, we risk losing a key strategic industry in Europe, just as energy transition geopolitics require supply chain diversification and a comeback of the European solar manufacturing sector.”