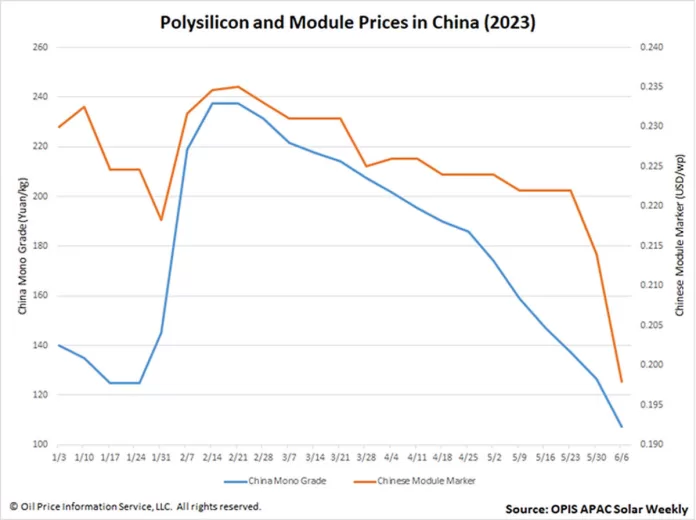

The Chinese Module Marker (CMM), which is OPIS’s standard measurement for modules from China, fell for the second week in a row to $0.198 per W. This happened because of big drops in the upstream parts of China, which drove module prices to their lowest level in almost three years.

This 7.48% drop, which is the biggest drop in percentage so far this year, puts CMM below the mentally important level of $0.2/W.

Several market players blamed the drop on China’s rising polysilicon production and the fact that polysilicon made in China is back to what one source calls a “reasonable price.” The price of the latter, which OPIS calls China Mono Grade, kept going down until it reached 107.5 CNY ($15.10)/kg.

Multiple sources said that the prices of modules in China are falling quickly, and that the starting bids for some recent domestic projects were all less than CNY1.5/W. 48.31 GW were put in place in the first four months of this year, which shows how much power is being used downstream. Still, module exports are still lower than planned because potential buyers are waiting to buy until prices drop even more, sources said. One experienced market watcher said that buyers will wait as long as their projects let them. He also said that he didn’t think falling module prices would stop.

OPIS predicts that prices will change a lot in the future because both buyers and sellers are waiting to see where the China module market goes. Pent-up demand from what one source calls “all-time high” buying and China’s National Energy Administration allowing a third batch of Gigawatt-base power projects means falling prices could find a floor.

The China Photovoltaic Industry Association says that by 2023, the country could have as much as 120 GW of solar power. But, according to another source, makers should be stockpiling a lot of modules, which, if put on the market, could mean that more downslides are on the way.

OPIS is a company owned by Dow Jones. It gives information on energy costs, news, data, and research for petrol, diesel, jet fuel, LPG/NGL, coal, metals, chemicals, and renewable fuels. In 2022, it bought price data from Singapore Solar Exchange and now puts out the OPIS APAC Solar Weekly Report.