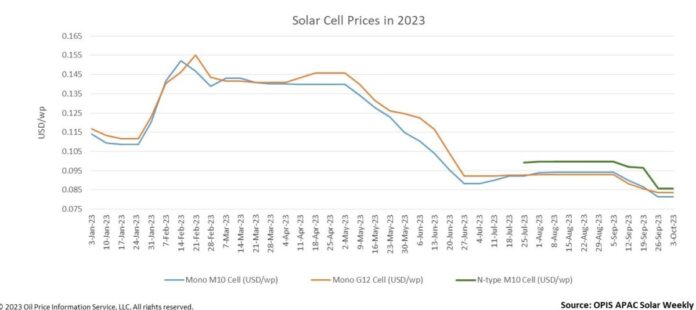

Due to restricted activity over China’s Golden Week holiday, solar cell prices stopped falling this week, halting a three-week slide. According to OPIS statistics, prices have temporarily stabilized at their lowest levels ever this week, with Mono M10 and G12 cell costs remaining stable at $0.0814 per W and $0.0836/W, respectively, and TOPcon M10 cell prices remaining unchanged at $0.0856/W.

The majority of industry insiders agreed that fresh record lows in cell pricing may be expected after the break. According to a seller source, the price of P-type M10 cells will fall to roughly CNY 0.61 ($0.085)/W after the holiday, whereas TOPCon M10 cells will continue to command a CNY0.05 ($0.0069)/W premium over p-type M10 cells.

A second seller source confirms the price difference between p-type and n-type M10 cells, estimating that p-type M10 cells may decrease to about CNY0.63 ($0.088)/W following the holiday. TOPCon M10 cells, however, would decrease to CNY0.68 ($0.094)/W

A market watcher claims that cell manufacturers are now keeping a profit margin of between 10% and 15%. Therefore, this source anticipated that after the vacation, there would still be an opportunity for mobile costs to drop.

Insiders predict that cell costs will drop, mostly as a consequence of downstream module companies’ decreased demand for cells as a result of certain module makers reducing their output. Furthermore, because of the extreme oversupply, module prices are also in negative territory. As a result, downstream pessimism will unavoidably affect cell pricing.

On the other hand, a source from an integrated player voiced doubt about the forecast that cell costs will drop after the vacation. The insider said, “After all, the price of cells has already dropped by roughly 14% over the last three weeks, which is a significant amount.”

According to a source from a specialized cell manufacturer, the amount that cell prices would decrease following the holiday depends largely on the price of polysilicon. Right now, there isn’t much room for wafer and cell prices to drop. The insider also stated that more substantial price reductions must wait until wafers and cells see price reductions due to polysilicon’s price decline.