According to Xiande Li, chairman and CEO of JinkoSolar, with these accomplishments, Jinko is “the first module manufacturer to ship 10 GW of n-type modules in a single quarter globally.”

Following the completion of its 1 GW US n-type module plant and 56 GW wafer-cell-module n-type production facility in Shanxi, China, the firm anticipates that n-type products will make up roughly 60% of its module sales in 2023.

It said that by the end of this year, its n-type capacity outside of China will surpass 8GW.

Jinko anticipates mono wafer, cell, and module capacities of 85 GW, 90 GW, and 110 GW annually, respectively, of which n-type will fulfill up to 75%. The business reported that for the remainder of 2023, their orderbook visibility is now at about 80%.

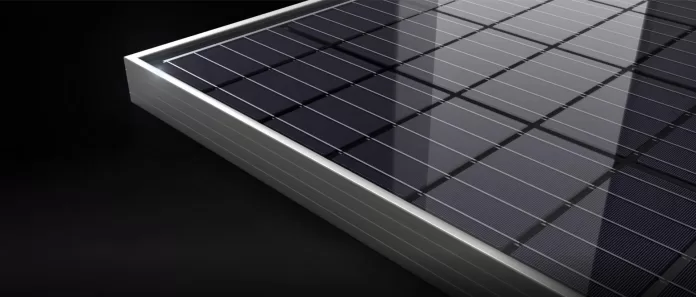

Jinko said that the efficiency of their mass-produced 182mm n-type tunnel oxide passivated contact (TOPCon) cells had reached 25.5% at the end of the second quarter and was expected to reach 25.8% by the end of the year.

Additionally, JinkoSolar disclosed their unaudited Q2 2023 financial data. The increase in demand and higher shipments led to a total revenue of RMB30.69 billion (US$4.23 billion), a 62.9% year-over-year gain and a 31.5% increase from RMB23.33 in the first quarter. Polysilicon’s decreasing trend was a major factor in the general decline in PV pricing during Q2.

Gross earnings increased somewhat from RMB4.04 billion in Q1 to RMB4.78 billion (US$659.6 million).

Li stated: “We are confident that demand will increase as prices stabilize and have increased our module shipping projection for 2023 to be in the region of 70–75 GW, with n-type modules accounting for about 60% of total module shipments. We will eventually invest in n-type capacity that is competitive in terms of technology and economics as the demand for n-type goods rises across the board.