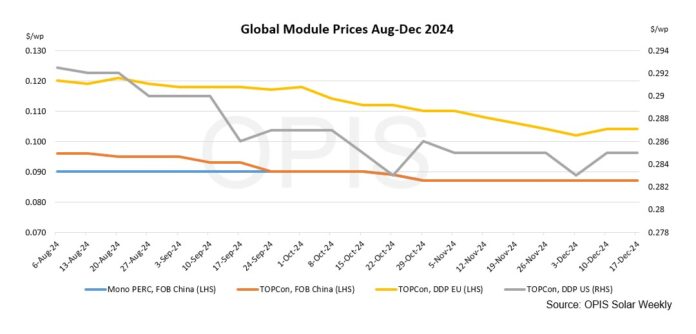

FOB China: The Chinese Module Marker (CMM), the OPIS benchmark evaluation for TOPCon modules from China, remained stable this week at $0.087/W Free-On-Board (FOB China), with price indications ranging from $0.083-0.095/W.

The module market remains stagnant while the industry assesses the impact of the newly signed “self-regulation agreement” by over 30 Chinese solar enterprises, which tries to stabilize prices by restricting supply.

“Most module manufactures are now expected to operate at 50-70% of capacity, down from 80% last year. Prices continue to fall due to weak demand, according to a producer.Despite these attempts, prices have showed little evidence of rebound. A top-five module maker informed OPIS that “strong sales pressure” and the need to remove outdated inventories impede major price rises, at least until the first half of 2025. Although manufacturers are urged to operate at reduced capacity in the coming months, market sentiment suggests that high inventory levels and poor turnover will keep prices low.

DDP Europe: TOPCon module prices have risen by another 1.00%. According to OPIS, the average price for Tier 1 panels is €0.099 ($0.102), with indications ranging from €0.075/W to €0.115/W.According to insiders, weak European module demand and strong selloffs in recent months have placed downward pressure on pricing. However, they predict DDP Europe panel values to rise somewhat by the end of December.

Freightos revealed freight rates for the China/East Asia-North Europe Ocean route, which dropped by 5.13% to $5,051 per forty-foot equivalent unit (FEU). This equates to $0.00126 per W.

DDP US: Prices were constant this week, with OPIS maintaining the spot price for utility-scale TOPCon modules at $0.285/W. According to forward estimates, the price for delivery in the first quarter of 2025 is $0.293/W, with Mono PERC modules costing $0.282/W.In anticipation of changes to the incentive under the new Trump administration, developers are still scrambling to lock up module inventories before the year ends in order to secure their projects’ eligibility for the ITC in 2024. Any business that places orders in the upcoming weeks must also accept delivery within three and a half months, according to one source. According to a distributor source, he is moving inventory swiftly, but if the ITC changes next year, developers should have until the new tax code goes into effect, maybe later in the year, to secure the eligibility of their projects for 2025.Market discussions are still dominated by price increases associated with the DOC’s late-November anti-dumping preliminary determination. A distributor source informed OPIS that a subject supplier hit with a high cash deposit rate had billed their customer around $0.41/W for Q1 delivery utility size TOPCon modules.

Some sources are dubious, even though it’s widely assumed that non-subject businesses will also boost prices to capitalize on the circumstance. According to a prominent developer, there is sufficient operational capacity in the United States and outside of the four subject countries to provide about 40 GW of annual demand. He added that the suffering will probably be temporary because the majority of significant suppliers have already made preparations to establish cell plants outside the area. A distributor told OPIS that although he had noticed a few-cent increase in pricing from Indonesia and Laos, it had not registered much because prices were still in the high teens and low.20s prior to the preliminary determinations.

Energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities, are provided by OPIS, a Dow Jones subsidiary. It currently releases the OPIS APAC Solar Weekly Report after purchasing pricing data assets from Singapore Solar Exchange in 2022.