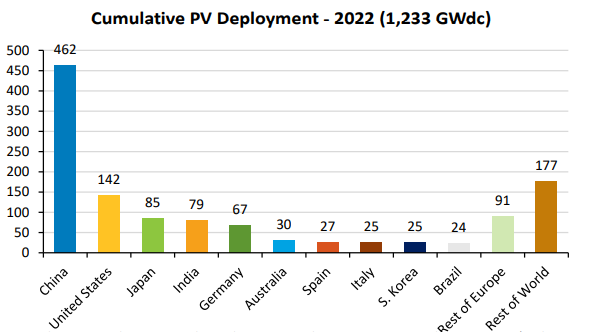

The National Renewable Energy Laboratory’s (NREL) Spring 2023 report on the solar market shows that PV is in high demand around the world. The International Energy Agency (IEA) says that 231 GW of solar were put in place around the world, taking the total to 1.2 TW.

China is still the leader in solar deployment. In 2022, its solar plants will grow by 57% year over year, meeting 42% of the world’s demand. If you’re looking for a place to stay, you’ve come to the right place. We’ve got everything you need right here.

Analysts at NREL say they think the number of installations around the world will hit 300 GW this year and 400 GW by 2025.

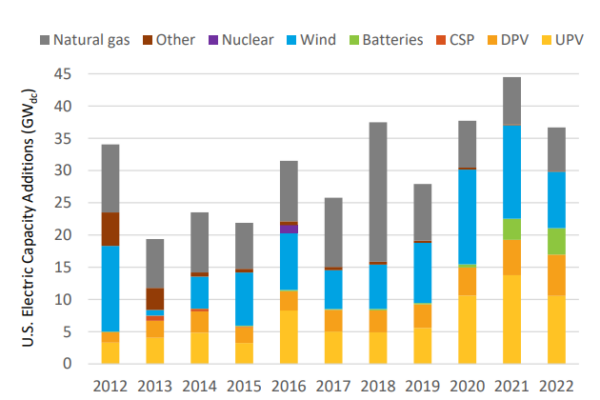

In the U.S., solar photovoltaics (PV) made up about 46% of new electricity-generating capability. This is a big jump from 2010, when they only made up 4%. But solar still has a long way to go before it can be a key part of the energy shift. NREL said that in 2022, PV will make up 9% of net summer capacity and 4.7% of yearly production.

With 27.3% of its energy coming from solar, California has made the most progress in this area. As of the end of 2022, 16 states get at least 5% of their power from solar.

The U.S. has put 140 GWdc of solar energy, which is a little more than 10% of all systems around the world. About 17% of the world’s energy is made in the U.S. NREL says that the country will add 20.2 GWdc of solar in 2022, but the American Clean Power Association (ACP) puts that number at 25.5 GWdc, which would make it the third biggest year for solar deployment. Installations were 15% slower than in 2021, which was mostly due to problems with getting parts for projects.

The U.S. added 14.1 GWh of energy storage, which is equal to 4.8 GW. This means that the average time that energy can be stored is now about 3 hours. Batteries and other forms of storage are used in a variety of ways, from short-term peaker plants that replace new natural gas peakers to long-term storage that matches the irregular cycle of solar production.

Pricing

Utility-scale PV systems in the U.S. have gone up in price by 13% over the past year, to $1.49 per Wac. The lowest price recorded for 2022 was $1.06 per Wac, and the highest price was $2.10 per Wac.

EnergySage says that prices for residential systems also went up, but less quickly, by about 6.3% year over year, with a typical price of $2.85 per Wdc.

Prices changed based on the size of the job. Prices changed in the following ways for a group of projects in Arizona, California, Massachusetts, and New York, which are all big markets:

units between 2.5 and 10 kW went up by 5% to $4.40/Wdc.

systems 10 to 100 kW went up 9% to $3.92/Wdc.

systems from 100 to 500 kW went up 4% to $2.59/Wdc.

systems from 500 kW to 5 MW went up 13% to $2.08/Wdc.

In January, the price of polysilicon was $20 per kg, which was the lowest it had been in 18 months. In mid-February, it went back up to $30 per kg, but by mid-April 2023, it had gone down to $24 per kg.

Even though demand is high, module prices have been going down regularly since autumn 2022 and are now at their lowest level in two years. In the first two months of 2023, the average price of a U.S. module was $0.36 per Wdc, which was 11% less than in the previous quarter. The price of modules was 57% higher than the spot price for monofacial monocrystalline silicon modules around the world.

Swanson’s Law describes the relationship between the average selling price of a solar module and the total number of modules shipped around the world. This relationship is shown on the solar PV experience chart. NREL found that the price of PV modules dropped by an average of 22% for every doubling of the total number of modules shipped from 1976 to 2022.

Manufacturing

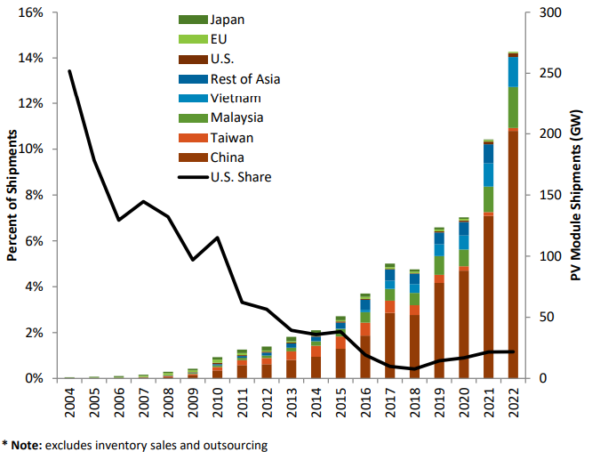

In 2022, the world sent out a lot more solar panels. The total was 283 GW, which was 46% more than in 2021. Most of the exports (96%), up from 35% in 2015, were monocrystalline silicon screens. N-Type modules are becoming more popular. They now make up 51% of all modules, up from 20% in 2020 and just 5% in 2019.

“With a higher open-circuit voltage, you can get a higher power level and better efficiency. On its own, that will probably lead makers to switch to n-type TOPCon cell designs as soon as they can, said Kenneth Sauer, a chief engineer at VDE Americas.

In 2022, the U.S. made about 5 GW of solar modules, but that number is likely to go up a lot because the Inflation Reduction Act has brought a lot of foreign and local funding to the U.S. to make solar components. ACP said that the $369 billion spending plan has already brought in $150 billion in private investments, which has led to 46 new production sites or major upgrades to existing ones.

Even though the U.S. is putting a lot of faith in local industry, it still imports a lot of goods. The U.S. Census says that in 2022, 28.7 GWdc of modules and 2.5 GWdc of cells were brought into the country. This is a 21% increase from the previous year. 73% of all module imports came from Malaysia, Vietnam, Cambodia, and Thailand. This makes the current policy fight over President Joe Biden’s ban on solar price imports from these four countries very important.

NREL said that in 2022, only 10% of modules, or about 2.7 GWdc, reported a price, compared to 56% (13.2 GWdc) in 2021.